As many households shoulder the burden of reduced income and companies cancel or postpone their annual remuneration review or bonus schemes, it’s no wonder that financial security tops the list of issues employees are concerned about.

A recently released survey from Reward Gateway revealed that 57% of UK employees (and 61% globally) felt that stress from the cost of living increases is negatively affecting their work, and nearly half of employees are demanding more resources to improve their financial, mental and physical wellbeing from their employers.

While the cost of living increases rage on as inflation hits a 30, even 40-year high, there are still ways of providing employees practical, financial support — and hope — in a challenging time.

Unsure of where to start or whether your efforts will make an impact? Ask your employees what they need and you may be surprised at what they’ll tell you and what problems you’ll be able to solve with even a limited budget. Below are some creative ways companies have responded to employee feedback and are making working through the cost of living increases a little easier on employees — and their back pockets.

| 1. Promote existing benefits that help support financial wellbeing |

| 2. Look ahead to springtime commutes and introduce Cycle to Work |

| 3. Provide material to support mental/physical wellbeing |

| 4. Congratulate and motivate employees with a mini-bonus |

| 5. Tap into the power of reward and recognition |

| 6. Ease the burden of working from home |

1. Promote existing benefits that help support financial wellbeing

Now is the time to promote the benefits that may save staff money, especially when you focus on the things that your employees are worrying most about. This might include:

| Access to an Employee Assistance Programme (EAP): | Some employees only consider accessing an EAP if they are dealing with grief or mental health challenges, and may need reminding that they may be able to access financial education or advice through your provider. |

| Making the most of a discounts programme: | Saving money on everyday items such as groceries can make a huge difference to families on reduced income. |

| Providing a salary advance or small loan: | Many employees may be reworking their household budgets, particularly if the earning capacity for those living under the same roof has taken a hit. Paying employees a salary advance or offering small loans on request can help alleviate the pressure of staying on top of rent, mortgage repayments or ongoing bills. |

| Making technology and white goods purchases easier |

Whether employees want to upgrade or replace their technology, or urgently finance a replacement washer/dryer, these can take a back seat during pressing financial times. Ease the burden by offering free financing with a technology salary sacrifice benefit like SmartTech™ |

Plus, with access to a Total Reward Statement such as what Reward Gateway provides, employees can understand all the benefits available to them and how they support their day-to-day in meaningful ways.

2. Embrace springtime commutes and introduce Cycle to Work

With tube and bus fares projected to rise even more, the cost of the average commute is undoubtedly hitting commuters’ wallets. Introduce a Cycle to Work scheme to help your employees buy cycling equipment through salary sacrifice.

With tube and bus fares projected to rise even more, the cost of the average commute is undoubtedly hitting commuters’ wallets. Introduce a Cycle to Work scheme to help your employees buy cycling equipment through salary sacrifice.

Cycle to Work benefits both employers and employees – your people can pay for a new bike pre-tax, straight from their paycheque, and employers benefit from NI contribution savings.

Plus, with Reward Gateway, employers can implement more than one salary sacrifice scheme in one centralised system, making approvals easy for time-poor HR teams.

3. Provide material to support financial, mental and physical wellbeing

Having easy access to healthy recipes to cook at home, mindfulness strategies to stay focussed and tips to maintain physical fitness can help employees stay on track and feeling well no matter what daily stressors they might be facing. But on top of that, our Wellbeing Centres offer a dedicated section on financial wellbeing and guidance for budget woes, too.

At the start of the pandemic, we launched over 240 Wellbeing Centres globally, to support companies in their efforts to maintain employee wellbeing and morale, and we continue to see renewed interest in wellbeing across our clients.

We also encouraged all of our own employees to use their Wellbeing Allowance to purchase fitness equipment or take up a class to stimulate their mental wellbeing, and offered to reimburse the cost of a running app to encourage more people to schedule movement in their day and work towards a goal of running 5km.

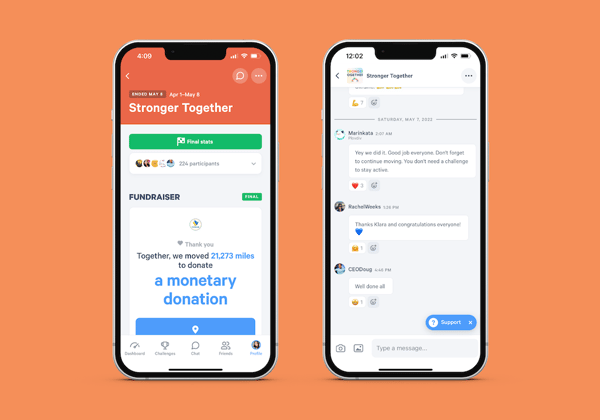

Recently, our CEO, Doug Butler, increased that incentive by personally committing a £16 donation to any employees’ charity of choice once they sent him a screenshot of their 5km run or walk or 25km cycle. It was a fantastic way to give employees permission to leave their work (from home) station and get outdoors while providing an opportunity to support a charity in a time when they might not be able to. To boost our sense of community at work, hundreds of RGers recently joined a 'Stronger Together' challenge on our new wellbeing partner mobile app, MoveSpring, to raise funds for Ukraine. Together, the team walked the distance of all of our global offices, which is more than 30k kilometres.

4. Motivate employees with a mini-bonus

While pay increases and big bonuses might be out of the picture for the immediate future, some organisations are using what they have to celebrate the efforts their people have made in recent months.

Symbio, a communications software and services provider, rewarded its 406 employees a £50 'You're doing great' mini-bonus during the pandemic, to thank them for how well they've adapted to remote working arrangements. Many companies are now adapting these mini-bonuses to provide needed support for everyday items.

5. Tap into the power of reward and recognition

If a mini-bonus is out of the picture, don’t forget your existing employee reward and recognition programme might be another way to provide employees financial stimulus. If your programme allows, employees who receive peer-to-peer recognition, manager or company awards that have a monetary value can redeem these to reduce or cover the cost of an essential or wish-list item.

Recognition will help with the community piece that people are missing, helping bring people together in a challenging time where mental health as well as financial health is affected.

Now, more than ever, employees need to be recognised for the impact they are making to support each other and their customers.

We are motivated by small wins, and reminding managers to recognise their teams not only boosts morale, it might be an opportunity to financially reward them too.

At a time when many are looking for relief, finding creative and low-cost ways to provide employees financial support through cost of living increases can be the perfect boost they’re looking for.

Not only will it lessen their stress and anxiety, but it will also help build employees' trust in you; an investment that will strengthen your company today and long into the future.

6. Ease the burden of working from home

Social distancing has forced millions of employees to temporarily work remotely from home — some for the first time. Not everyone has an environment that is ideal and providing even some basic equipment can improve employees’ engagement, as well as physical and mental wellbeing.

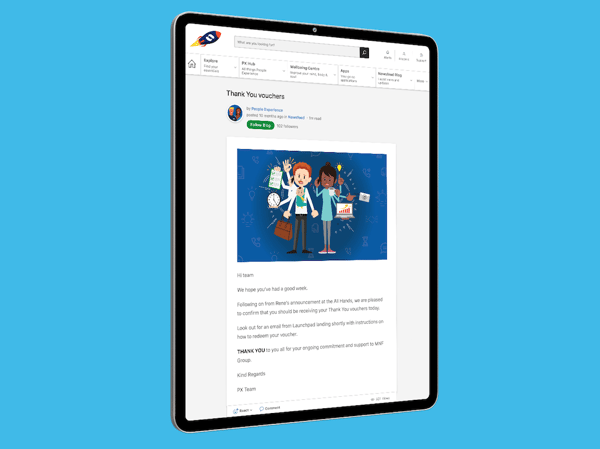

In response to a survey our employees completed at the start of the pandemic, Reward Gateway introduced a Work From Home Bundle benefit that offers all our employees items to improve both the current and future work from home situation.

While many offices are re-opening, the reality is many are likely to work from home on occasion long after this pandemic ends.

The bundle includes a chair, desk, laptop stand and a keyboard and mouse. Employees can either request that Reward Gateway makes the purchase and organises delivery to their home address, or they can pick their own equipment and claim a certain amount to make it more affordable.

Creating a benefit that removes or at least softens the cost of setting up a workstation at home is an investment that many will take advantage of as hybrid working takes its permanent place in the evolution of the workspace.

Need other ideas for how you can help boost employees' income? Get in touch with a member of our team to see how we can support your employees during the cost of living increases.