3 min read

There's something that's impacting the productivity, engagement and physical and mental health of at least 51 percent of your employees so much that it's making them consider whether it's time to leave your company. It isn't their manager, their role, or the lack of reward or recognition. It's financial stress.

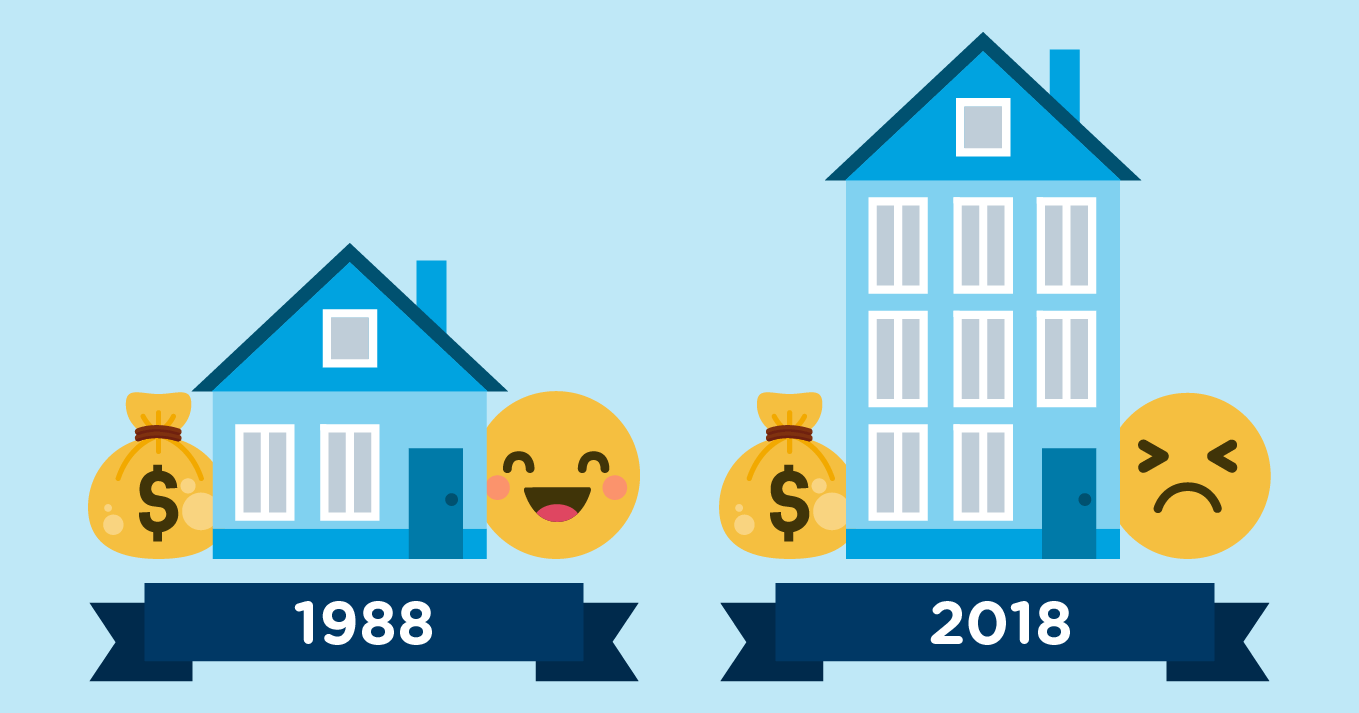

A recent study by Willis Towers Watson found that 51 percent of Australian employees have significant worries about their current financial state and 41 per cent have significant worries about their future financial state. This shouldn’t come as a big surprise, since the household debt to disposable income ratio in Australia has climbed to 200 percent in the last 20 years.

Pair this with the Reserve Bank of Australia’s recent projections for minimal wage growth, and you're left with millions of Aussie employee stressing about how to handle grocery bills, mortgage repayments and school fees and wondering if it’s worth looking for a new company who can give them the pay rise they need.

Our latest infographic looks at how employers can engage their existing employees by helping them save money on everyday expenses and, while alleviating some financial burdens, create a compelling Employee Value Proposition that attracts new people for their organisation.

An employee discount solution such as Reward Gateway’s employee benefits program helps employees save money each and every day by providing discounts at hundreds of Australia’s leading retailers, from groceries and petrol to entertainment, fashion and travel. On average, employees can save up to $4,000 per year, depending on their monthly habits. That’s an increase in employees’ disposable income of up to 10%, for an average investment of less than 0.1% of payroll.

Giving every employee the equivalent in a pay rise would be cost-prohibitive for most companies, but it is possible for employers who are smart about how they package and offer employee benefits.

Employee benefits programs form one part of your engagement journey, but it’s a simple step to take to boost your EVP and increase engagement right away, while making a tangible impact to the everyday lives of your people.

Joy Adan

Joy Adan