6 min read

As many households shoulder the burden of reduced income and companies cancel or postpone their annual salary review or bonus programs, it’s no wonder that financial security tops the list of issues employees are concerned about.

COVID-19 has left over 20.5 million Americans without jobs in just a matter of weeks, and even more working in unusual conditions. The World Economic Forum has gone so far as labelling the rising anxiety over its economic consequences a “second pandemic."

While employers have no way of predicting when business will return to normal, there are still ways of providing employees practical, financial support — and hope — in a challenging time.

Unsure of where to start or whether your efforts will make an impact? Ask your employees what they need and you may be surprised at what they’ll tell you and what problems you’ll be able to solve with even a limited budget. Below are some creative ways companies have responded to employee feedback and are making working through the next phase of the pandemic a little easier on employees — and their back pockets.

1. Ease the burden of working from home

Social distancing has forced millions of employees to temporarily work remotely from home — some for the first time. Not everyone has an environment that is ideal and providing even some basic equipment can improve employees’ engagement, as well as physical and mental wellbeing. This is why some companies have offered to pay for items that will allow their people to set up an effective workspace at home.

In response to a survey our employees completed a few weeks ago, Reward Gateway introduced a Work From Home Bundle benefit that offers all our employees items to improve both the current and future work from home situation.

While we will eventually re-open our offices in the future, the reality is many are likely to work from home on occasion long after this pandemic ends.

The bundle includes a chair, desk, laptop stand and a keyboard and mouse. Employees can either request that Reward Gateway makes the purchase and organizes delivery to their home address, or they can pick their own equipment and claim a certain amount to make it more affordable.

Creating a benefit that removes or at least softens the cost of setting up a workstation at home is an investment that makes sense in the immediate environment, but actually sets us up well for a future where remote working will likely be the norm.

2. Promote existing benefits that help support financial wellbeing

Now is the time to remind employees about anything already available to them to support their wellbeing. This might include:

| Access to an Employee Assistance Program (EAP): | Some employees only consider accessing an EAP if they are dealing with grief or mental health challenges, and may need reminding that they may be able to access financial education or advice through your provider. |

| Making the most of a discounts program: | With schools and gyms closed, more families are purchasing technology, fitness equipment and even gardening gear as they spend time at home. Saving money on any of these purchases, in addition to everyday items can make a huge difference to families on reduced income. |

| Providing a salary advance or small loan: | Many employees may be reworking their household budgets, particularly if the earning capacity for those living under the same roof has taken a hit. Paying employees a salary advance or offering small loans on request can help alleviate the pressure of staying on top of rent, mortgage repayments or ongoing bills. |

3. Introduce a “Book Benefit”

While we are all spending more time at home, many are looking for things to stay entertained and stimulated. One tried and true way to accomplish both of these things is to do more reading.

In addition to reducing stress and promoting empathy and emotional intelligence, reading can help build skills for the future and provide employees an opportunity to connect and discuss something that isn’t directly related to work.

Reward Gateway’s original book benefit allowed employees to purchase books for their professional benefit (we covered both the item and shipping cost), but have since expanded it to include one book for personal enjoyment to be purchased once a month.

4. Provide material to support mental/physical wellbeing

Having easy access to healthy recipes to cook at home, mindfulness strategies to stay focused and tips to maintain physical fitness can help employees stay on track and feeling well throughout their time away from the office.

In March and April, we launched over 240 Wellbeing Centers globally, to support companies in their efforts to maintain employee wellbeing and morale.

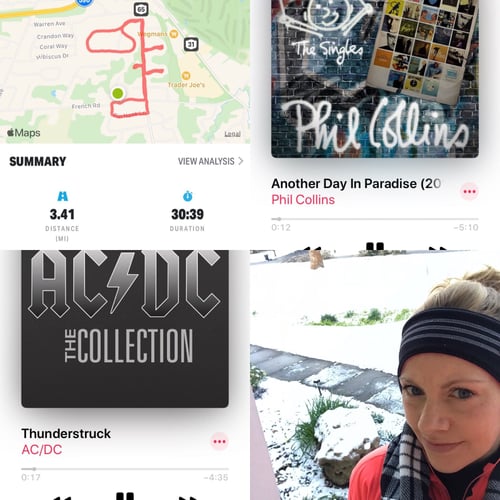

We also encouraged all of our own employees to use their Wellbeing Allowance to purchase fitness equipment or take up a class to stimulate their mental wellbeing, and offered to reimburse the cost of a running app to encourage more people to schedule movement in their day and work towards a goal of running a 5k.

Recently, our CEO, Doug Butler, increased that incentive by personally committing a $25 donation to any employees’ charity of choice once they sent him a screenshot of their 5k run or walk or 25k cycle. It was a fantastic way to give employees permission to leave their work (from home) station and get outdoors while providing an opportunity to support a charity in a time when they might not be able to. Although my 5k run was a little snowy and chilly, it was a great opportunity to donate to Foodlink in Rochester, NY.

Within the first week of issuing the challenge, Reward Gateway employees achieved over 250k of exercise and more than $1,200 contributed to great charities around the globe.

5. Congratulate and motivate employees with a mini-bonus

While pay increases and big bonuses might be out of the picture for the immediate future, some organizations are using what they have to celebrate the efforts their people have made in recent months.

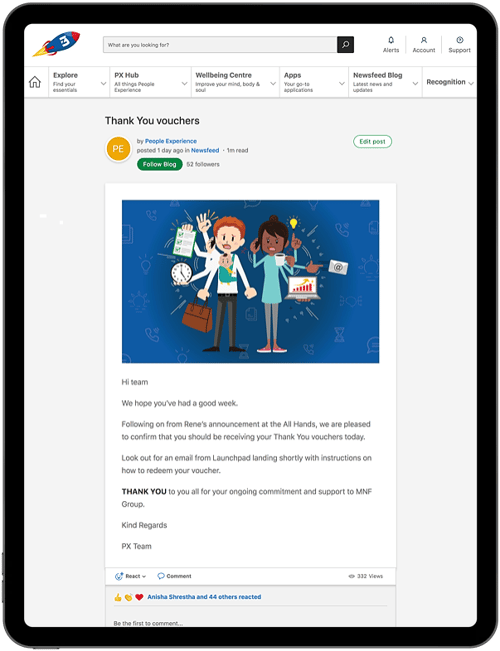

Symbio, a communications software and services provider, rewarded its 406 employees a $100 “You're doing great” mini-bonus, to thank them for how well they've adapted to remote working arrangements.

6. Tap into the power of reward and recognition

If a mini-bonus is out of the picture, don’t forget your existing reward and recognition program might be another way to provide employees financial stimulus. If your program allows, employees who receive peer-to-peer recognition, manager or company awards that have a monetary value can redeem these to reduce or cover the cost of an essential or wish-list item.

Now, more than ever, employees need to be recognized for the impact they are making to support each other and their customers.

We are motivated by small wins, and reminding managers to recognize their teams not only boosts morale, it might be an opportunity to financially reward them too.

At a time when many Americans are looking for relief, finding creative and low-cost ways to provide employees financial support through COVID-19 can be the perfect boost they’re looking for. Not only will it lessen their stress and anxiety, it will help build employees' trust in you; an investment that will strengthen your company today and long into the future.

Have you seen other great examples of how companies are providing employees financial support at this time? Connect with me on LinkedIn or drop me a message — I’d love to hear about them!

.jpg?width=60&name=Ryann%20Redmond-274%20(1).jpg)

.jpg)