With inflation causing sharp rises across many day-to-day costs, it’s down to employers to support the financial wellness of their people before it leaves a serious dent in workforce health and performance.

According to the latest research from SecureSave, an emergency savings startup, 75% of Americans say money worries have already impacted their work performance, either through lost sleep, health problems such as stress or anxiety, or lack of focus. That has a big domino effect in terms of productivity – and it’s something employers can’t afford to sweep under the rug.

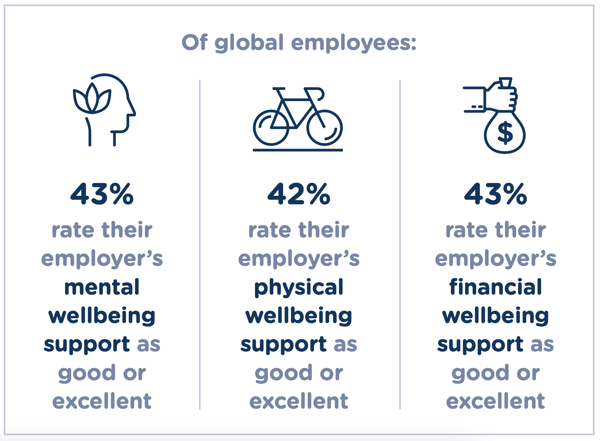

Our recent research echoes these statements, with only 43% of employees worldwide rating their employer’s financial wellbeing support as “good” or “excellent,” but over half frequently experiencing stress at work and 4 in 5 battling dips in job performance due to burnout.

Of course, employees aren’t the only ones feeling the pinch right now. Organizations across all sectors are looking for company-wide raise alternatives and new, cost-effective ways to engage staff and promote good financial behaviors. Many have already turned to hybrid and remote working as a way to reduce overhead and develop a more flexible workplace culture – but could this also have a positive impact on employee financial wellness?

We know that hybrid working or working fully remote isn’t possible for all organizations or all employees, but flexible working still remains a must-have for employees in the new world of working.

An all-encompassing employee discounts program like the one Reward Gateway offers can help lessen the financial burdens of everyday costs, no matter where your employees are working, but employers can do more to minimize day-to-day expenses simply by offering hybrid and remote options.

Let’s take a closer look at three key ways in which going remote can ease the strain on your employees’ purse strings.

| 3 ways remote work improves employee financial wellness |

| 1. Cut down commuting costs |

| 2. Reduce childcare expenses |

| 3. Lessen “office wardrobe” spend |

1. It cuts out commuting costs

Avoiding the need to pay for a daily commute to the office is one of the most significant cost savings of remote or hybrid work. It’s not just the cost of bus passes or parking either – people generally tend to spend more on food and social activities when they commute to an office.

Avoiding the need to pay for a daily commute to the office is one of the most significant cost savings of remote or hybrid work. It’s not just the cost of bus passes or parking either – people generally tend to spend more on food and social activities when they commute to an office.

So, how much can employees really save by ditching the need to hop in the car, bus or train every day? Let's look at some statistics to help put costs into perspective:

Calculations of government-provided statistical data by Clever.com found that the average commuter spends $867 on fuel and $410 on vehicle maintenance each year – and that doesn't account for additional parking costs or tolls.

The Bureau of Transportation Statistics found that the cost of public transportation rose by 1.7% from 2020 to 2021 – which would make the average monthly pass cost over $60 in 2023.

2. It reduces childcare expenses

Childcare costs can be a major burden for families that need to work full-time, yet can’t afford to drop their hours. This is especially the case for lower-wage employees that spend a higher percentage of their salary on childcare, or families with younger infants and children with special needs that require extra care.

Even if it’s for a few days a week, working from home can give parents the option to keep an eye on their children while they get on with their work.

This means they don’t have to fork out thousands of dollars for private childcare and nurseries every year.

Care.com found that, in 2022, the average child care cost for one child in the U.S. was $694/week for a nanny, $226/week for a child care or day care center and $221/week for a family care center.

Don’t forget that a more flexible model of work allows parents to work around certain times in the day when they need to be available for their children, such as picking them up from school or taking them to appointments. This saves a lot of time and stress involved with making extra arrangements, most of which lead to them spending more money and detracting from their focus on work.

3. It lessens the need to buy "office wear"

Most workplaces have a defined dress code, whether it’s formal suits and dresses, smart-casual, designated uniforms, or something else in between.

Most workplaces have a defined dress code, whether it’s formal suits and dresses, smart-casual, designated uniforms, or something else in between.

While the specifics differ from business to business, employees are generally expected to look respectable from head to toe. That means maintaining a wardrobe which can cater for five days a week in a professional workplace. For the occasional shop, my favorite retailers to look at on our discounts platform are Asos, where we save 7% and Macy’s, where we can save 10%!

Appearances are still important for remote workers, of course, though most employees naturally feel a need to look their best in a workplace environment. That pressure can lead to them spending a large chunk of their earnings on shirts, blouses, trousers, shoes and jackets that they otherwise wouldn’t feel the need to buy.

Remote working eases this pressure and helps employees manage the cost of their wardrobe by avoiding the need to purchase new clothes specifically for the office.

Looking for more ways to support financial wellness for your remote employees? Find out more about our range of creative discounts, savings and benefits designed to cut the average employee’s daily costs, no matter where they call “work.”

Carla Sutherland

Carla Sutherland