With cost of living consistently rising and Australians struggling under the pressure of inflation and interest rate increases, an employee discounts program is more important than ever before.

For Australian businesses, offering an employee discounts program provides crucial relief to workers, boosting financial wellbeing and allowing them to put more money into their employees’ pockets, without the often prohibitive costs of salary increases.

Unfortunately, sometimes it’s a struggle to explain this to senior stakeholders and get that essential executive buy-in and budget sign-off.

For more on this, check out our webinar: The Business Case for Benefits and Recognition: Securing Budget Approval and Buy-In.

So, how can HR professionals and leaders build the business case for a discounts program with some compelling stats to strengthen their argument?

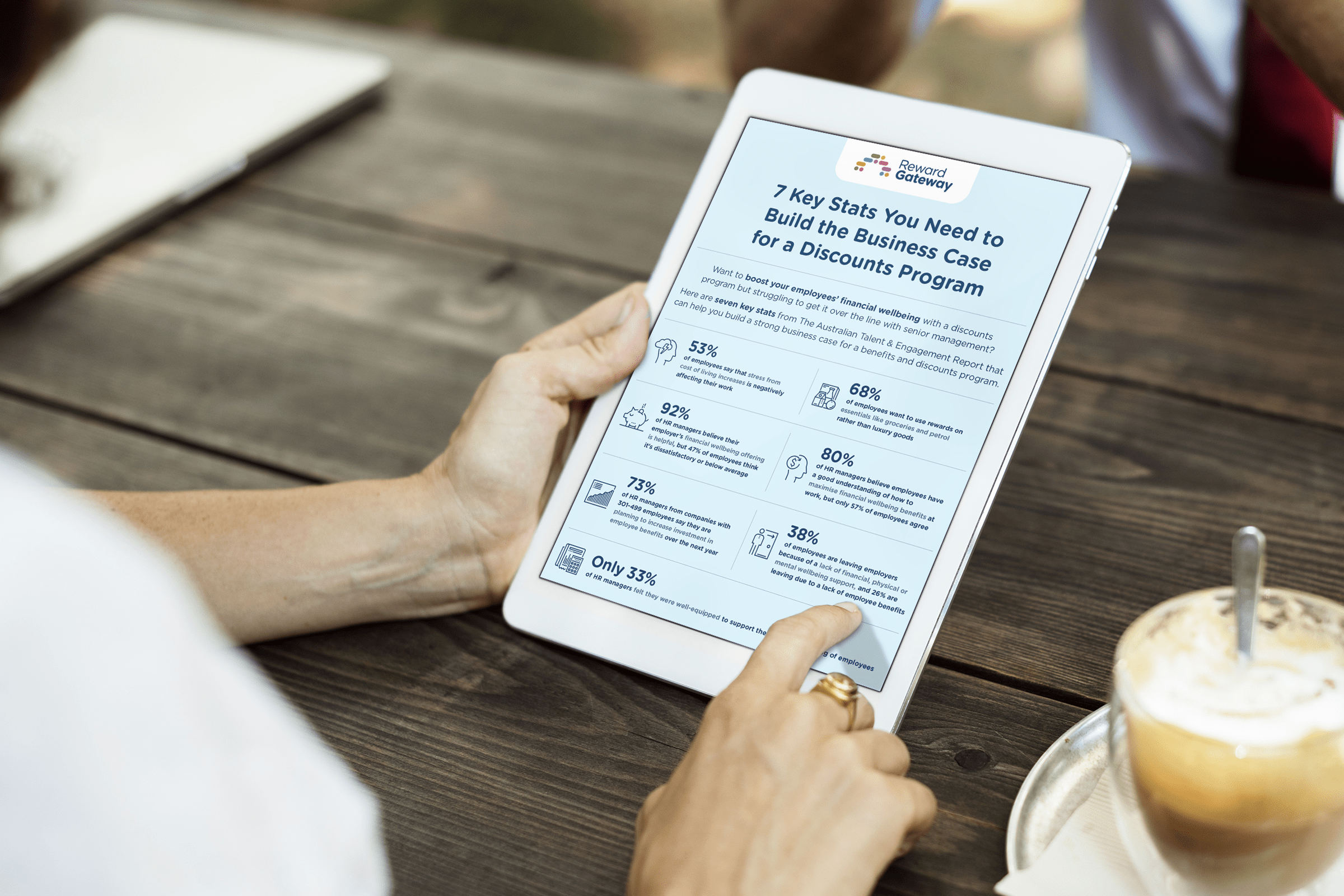

Here are seven key stats from The Australian Talent & Engagement Report that can help you build a strong business case for a benefits and discounts program. Scroll down for our accompanying infographic as well!

1. Stress from cost of living impacting work

According to our research, 53% of Australian employees say that stress from cost of living increases is negatively affecting their work.

That’s a huge number; when over half of Australian employees are saying that cost of living is negatively impacting their work, it’s time to consider the wide-ranging ripple effects of this financial strain and what your business can do to mitigate this.

2. Employees spending on essentials

Our next handy stat is that 68% of employees want to use rewards on essentials like groceries and petrol rather than luxury goods.

When giving out financial rewards as part of your reward and recognition program, more than two thirds of Australian employees are choosing to divert that reward money to everyday essentials, rather than luxury goods. This reflects a clear shift in how people spend their discretionary income as budgets tighten.

3. Differing perceptions of financial wellbeing offering

Next up, our research found that 92% of HR managers believe their employer’s financial wellbeing offering is helpful, but 47% of employees think it's dissatisfactory or below average.

This is such an interesting insight as it really shows the importance of employee surveys and really understanding how your employees are feeling and whether they’re making the most of your benefits and wellbeing offerings. We saw this across our data, no matter the industry, there was a distinct disconnect between HR and employee perceptions.

4. Mismatch on how helpful the benefits are

Additionally, 80% of HR managers believe employees have a good understanding of how to maximise financial wellbeing benefits at work, but only 57% of employees agree.

We’re again seeing a clear difference between how HR managers view take-up of benefits and how much employees adopt and embrace them.

5. Ill-equipped to support financial wellbeing

Our research found that only a third of Australian HR managers felt they were well-equipped to support the financial wellbeing of employees.

If two-thirds of HR managers feel they don’t have the right tools to offer financial support and wellbeing to their people, then that’s a clear issue.

6. HR increasing investment in employee benefits

Another interesting insight is that 73% of HR managers from companies with 301-499 employees say they are planning to increase investment in employee benefits over the next year. For those with 100-300 employees, 67% will be increasing their investment in employee benefits.

While this drops to 53% for HR managers from companies with over 2,500 employees, that’s still over half of HR managers surveyed who think they need to increase investment in employee benefits and discounts.

7. Employees are leaving due to lack of support

Finally, our research revealed that 38% of employees are leaving employers because of a lack of financial, physical or mental wellbeing support.

Additionally, one in four employees are leaving due to a lack of employee benefits. This demonstrates a clear business need for strong employee benefits and discounts.

For those with tight HR budgets, who are sick of hearing ‘do more with less,’ a discounts program offers an impactful alternative when pay increases aren’t an option, allowing you to put money back into the pockets of your employees.

Check out our infographic below for a handy comparison table where you can compare the cost and impact of a 3% salary increase versus a discounts program.

_7%20key%20stats.png?width=600&height=1140&name=2023_Key%20stats%20to%20build%20the%20business%20case%20for%20discounts%20program%20infographic_AU(v1)_7%20key%20stats.png)

Looking for guidance? Reach out to me and the team for a personalised consultation around how we can help build your business case for an employee discounts program. Email me at phoebe.hutton@rewardgateway.com.

Phoebe Hutton

Phoebe Hutton