5 min read

Recently, we welcomed Nicola Marshall, People Director at Welcome Break for a live chat with our team and bestselling author Debra Corey to discuss how to design an effective employee benefits strategy for a dispersed, young workforce.

Welcome Break is a highly diverse business, with 5,500 employees from more than 80 nationalities. Policy changes in the EU led to a strain on retention and increased turnover, so the company looked at its benefits offerings to see how it could offer a more rounded approach to reward for its employees to aid in attracting and retaining people.

Welcome Break is a high-growth motorway service operator with 34 different locations, representing hundreds of brands and a largely offline workforce.

The business recently became a fully franchised business, where the team members work for the parent organisation Welcome Break, but represent and wear the uniforms of a variety of brands such as KFC, Subway, Starbucks, Ramada, etc, creating candidate competition between Welcome Break and High Street larger brands.

These changes led the team to take a closer look at reinventing its Attraction and Retention plan, which introduced a variety of positive changes across the business.

Because of the programmes Welcome Break put in place, it has benefitted from an 8% reduction in turnover, and a £135k decrease in spending on recruitment agencies since 2017.

Let’s take a closer look at how Nicola improved employee retention at Welcome Break, and some of the questions the audience asked her at the end of the webinar, with a few notes from Debra as well:

Q: What methods do you use to gather actual information if the employees are satisfied with their level of benefits?

Nicola: We ask them. We use pulse surveys and more detailed surveys, and we regularly hold group forum meetings. All of our Sites also hold their own Forum meetings every month, so we receive feedback from those, too and regularly ask the Forum leaders to ask certain questions on our behalf.

Q: When you’re looking at going beyond the “normal” benefits that your competitors might offer, what do you look for?

Nicola: We are always looking at new, innovative employee benefits that will make a difference to our Team and that our Teams will actually use. But these need to be cost-effective as we don't have a big budget, and to introduce something new generally means we need to take away something under-utilised or not valued by the Team. If we had a benefit that was a big draw from our competitors, then obviously we would look at this. However, our competitors are not necessarily other Motorway Services businesses.

Debra: I think it starts with understanding what is right for your company and your workforce and creating a balanced portfolio of benefits.

When it comes to innovative benefits, they can be great, but only if they meet the needs of your workforce. If they don't, it's like a fancy item on a restaurant menu that nobody orders.

Q: Have you come across a situation where staff have asked for a benefit that did not sit well with the organisation?

Nicola: Yes. We used to provide transport to and from work. But benefit in kind implications changed and we had to stop this. This has become a legacy and it continues to be talked about "the good old days of the Welcome Break bus"!

We regularly get asked to reinstate this and have to explain why this is no longer possible — if we could, we would! We did put in place a new Cycle to Work scheme to help reduce the complexity of limited public transport, and we’ve seen some good takeup on it since we launched. Clearly we don’t see our Team cycle on the motorway — most of our sites have an alternative entrance that’s not available to the general public!

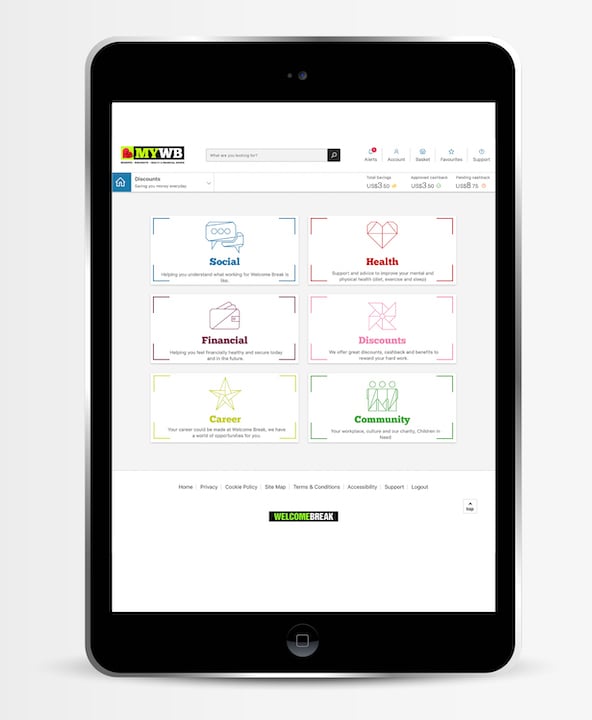

A look at Welcome Break's employee benefits hub

Q: How do you get buy-in from senior leaders when you’re trying to get financial wellbeing initiatives off the ground?

Nicola: We looked for suppliers that met the needs of our Teams. We reviewed a number of suppliers that could offer an alternative to payday loans but that didn't have a risk attached to the business, so we didn't provide the loan ourselves.

We’re also clear that we are not offering financial advice and act as an intermediary in putting the Team into contact with organisations that can help them.

Senior buy-in at our executive level was straightforward, we explained to them that it would help reduce turnover and also walked them through the more 'hidden' costs to the business – lost productivity, the cost to recruit, cost to train and to make the hiring process more effective.

We also talked more about giving people a reason to stay instead of reasons to leave, so retention was a big focus in our plan.

Debra: I would share with them statistics to show the impact of financial wellbeing on the workforce and the company.

Here are a few numbers from Salary Finance's 2019 report:

- 36% of employees are worried about money.

- Money worries are significantly greater than the worries about career, health or relationships.

- Those with financial worries are 4.1 times more likely to be suffering from anxiety and panic attacks, and 4.6 times more likely to be suffering from depression.

Financial wellbeing has a significant impact on absenteeism, productivity, engagement and retention. The impact is between 9-13% of total salary cost. When you track those numbers back to your business reality, the argument is clear.

Q: Nicola, how did you run the employee survey to get to your five pillars for her attract/retain strategy?

Nicola: Through our face to face "fishbowl" meetings, we were able to identify the key areas where we were being asked to provide support. We put these suggestions into “buckets” and looked for themes.

Following some Gallup research at the time, we were able to structure our “wellbeing pillars” into similar themes that were relevant to our business.

Curious about how to design a benefits programme for the modern workforce? Check out the full webinar below:

Megan Wiseman

Megan Wiseman