If you groaned at the sight of Christmas in September, you’re not alone. But whether it’s too soon or not soon enough, the festive season is just around the corner. That means it’s time to start thinking about what we can do to celebrate and reward our employees for their hard work and loyalty, as well as support their financial wellbeing at a time when giving to others takes centre stage.

The rising cost of living is affecting people all over the UK, in all walks of life. The increases in costs for housing, groceries, fuel, utilities and travel – to name a few – have put immense pressure on many household budgets, leading to significant pullbacks in discretionary and social spending. But as we approach the festive season, that’s not where people like to go: Normal retail behaviour shows the typical household spends around 30% more in December than any other month. We want to be a little more frivolous with our spending around the holidays, to feel like we can put some money towards our celebrations without bankrupting January.

In our webinar, Maximise Rewards & Benefits to Support, Connect and Retain Your People, we talked about strategies that HR leaders are using to support their workforce.

Here are some suggestions we got from attendees on supporting general wellbeing:

Gabrielle B: We have wellbeing advocates who are available to support [employees]; they regularly run talks and events.

Jenna W: We have a financial wellbeing plan for the full year, looking at will writing, promoting our cash plan, discounts (via Reward Gateway). The one which went down really well was our ‘planning to stop work’ workshops, which were essentially about saving for retirement, but we found renaming it meant that younger colleagues came along to the sessions, too.

Beverley O: I researched discount websites and promoted apps, such as Too Good To Go, money-saving expert website which?, petrol price checker – practical and helpful tools for everyone to use at no cost.

Amanda H: We have wellbeing Wednesday at lunchtime every 2 weeks that focusses on so many topics: sleep, depression, prostate, cholesterol, etc. – these are [Microsoft] Teams calls where experts internally or externally deliver a presentation.

Amy T: [We have a] 12 days of Christmas celebration, a mixture of fun (raffle, Christmas jumper day, hot chocolate stand) and charity (writing letters to vulnerable people, shoebox appeal, homeless socks and chocolates).

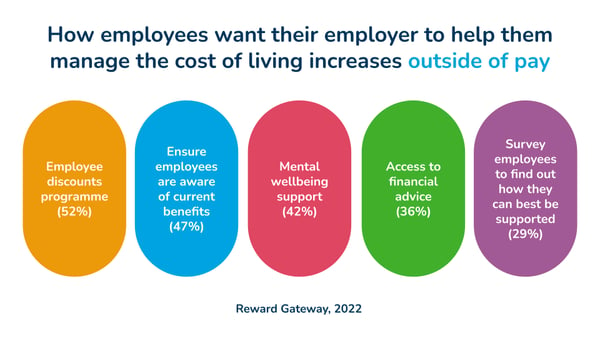

We loved those specific ideas – and many others shared in the chat – but we also have some research that points to what employees most want, specifically financially. Outside of increasing pay, more than half of UK-based employees want access to a retail discounts platform. Secondarily, employees noted that their awareness of their benefits isn’t everything it could be. Additional answers included support for mental wellbeing, as well as more direct communication from leadership – see the chart below.

Benefits of a discounts platform

An effective employee discount programme can really offset the challenges posed by the increasing cost of living by providing financial relief – giving staff exclusive access to discounts on everything from groceries, utilities and clothing to travel, DIY and days out with their family – you name it. If you can stretch your employees’ household budgets significantly, a discounts platform like the one Reward Gateway offers can be a great way to do that.

From an emotional and mental wellbeing perspective, it’s going to alleviate some of the financial pressures that they may be experiencing, as well. It has a really positive impact on retention and loyalty because employees are more likely to stay with an organisation that demonstrates it cares about their financial stability. But ultimately, it communicates a company’s commitment to supporting its workforce during these challenging times.

From an emotional and mental wellbeing perspective, it’s going to alleviate some of the financial pressures that they may be experiencing, as well. It has a really positive impact on retention and loyalty because employees are more likely to stay with an organisation that demonstrates it cares about their financial stability. But ultimately, it communicates a company’s commitment to supporting its workforce during these challenging times.

Salary, we know, is the most expensive way to give to your employees more money. And when you factor in National Insurance contributions and pension into every pound that you give your people, giving an employee £10 can actually cost you more like £15 – whereas a well-used discounts platform can give the effects of a pay rise by helping to put money back into their pockets, but at a fraction of the cost. And discounts are also a benefit that tends to unify everyone – everyone needs to buy food and clothes, after all. So it has the ability to positively impact every single person within your organisation, regardless of their economic circumstances.

HomeServe saw a surge of colleagues taking advantage of their SmartTech benefit throughout 2022, seeing over 1,100 orders placed to the value of over £360,000 on items like smartwatches, TVs and AirPods. HomeServe saw a surge of colleagues taking advantage of their SmartTech benefit throughout 2022, seeing over 1,100 orders placed to the value of over £360,000 on items like smartwatches, TVs and AirPods. |

Discounts present an opportunity for a low-cost, high-impact benefit that can be swiftly implemented. But they’re not the only solution out there; there are other solutions that can add significant value to your colleagues. For example, tech spending often surges during the festive season, so providing accessible options such as SmartTech for your employees can have a monumental impact on preventing predatory loan services or other un-ideal avenues to pricier gifts. (SmartTech is a salary deduction benefit that allows employees to repay those expensive tech purchases through their monthly salary.

More ways to provide support

One of our attendees offered their ‘12 Days of Christmas’ programme, where they host a giveaway each day leading up to Christmas. At Reward Gateway, we used our ‘12 Days of Christmas’ to highlight existing benefits we refreshed and to introduce a few new benefits to the package. Additional suggestions included Christmas jumper days or pyjama days (not just for kids!), £50 vouchers to Sainsbury’s and an increased focus on recognition.

One of our attendees offered their ‘12 Days of Christmas’ programme, where they host a giveaway each day leading up to Christmas. At Reward Gateway, we used our ‘12 Days of Christmas’ to highlight existing benefits we refreshed and to introduce a few new benefits to the package. Additional suggestions included Christmas jumper days or pyjama days (not just for kids!), £50 vouchers to Sainsbury’s and an increased focus on recognition.

Free financial advice

Pointing to free money advice on external sites might seem really obvious, but when we are feeling strapped or stressed, we’re less likely to be resourceful. So if you offer an article about ways to save on one’s weekly shop, that itself can let people know you care. You can also set up classes with internal experts: Do you have a CFO or an HR business partner with a financial background? They can speak to people in live sessions about how to make use of the resources you already have.

Interested in seeing how a discounts platform could help your employees this festive season? Schedule a quick call with one of our friendly employee engagement experts and get started today.

Oonagh Howley-Smith

Oonagh Howley-Smith